From the profligate to the unprofitable to the just plain stupid, here are ten examples of money most of us would have spent far more responsibly. Top 10 Weirdest Things People Sell And Actually Make Money On

10 Dunce of Diamonds

Any sentence that references rappers and jewelry is likely to detail a questionable-at-best expenditure, but this one takes the cak… uh, carat: Rapper Lil Uzi recently had a $24 million diamond implanted in his forehead. His reason? He was worried that he’d misplace the jewel were it set in something more conventional, like a ring. So basically a guy who couldn’t trust himself to hang on to a $24 million ring trusted himself enough to have a $24 million diamond sewn into his head. According to Simon Babaev of New York-based jeweler Eliantte & Co’s, Lil Uzi’s big diamond is secure because jewelers created a “specific mounting that clips and locks in place.” Instead of using stainless steel or surgical-grade steel, Babaev said the team did everything with precious metals. “There’s a whole mechanism involved, it’s not a standard piercing. A specific piece and part were both engineered with millimeter precision to get this put on him,” he said. That’s a lot of brainpower for something so brainless. Reassuringly, Babaev insists that an expert team put their heads together before Gorilla Gluing a jewel into this humble gent’s head. “We made sure that prior to getting anything done that Uzi brought someone in to consult on everything. We didn’t just do this randomly.” And don’t worry, said Babaev: the procedure is not dangerous. “As long as you maintain it well and have good upkeep, it’s perfectly fine. It’s as safe as any other piercing.” Babaev did not comment on the “safety” of someone inevitably cutting Lil Uzi’s head open while he sleeps to steal a $24 million diamond.

9 Brazil’s Ghost Stadium

The world has no shortage of poorly conceived stadiums. In England, libraries could be filled with the amount of copy dedicated to trashing London Stadium, home to the West Ham football club. Florida’s Tropicana Field is home to the Tampa Bay Rays, who play baseball in a domed stadium whose roof isn’t high enough for pop flies and is painted the color of (you guessed it) a baseball.

8 Rodent Wrestling

For more than two decades, researchers at Northwestern University in Illinois received National Institutes of Health funding to watch hamsters fight each other. The project – which is probably even cooler if you’re stoned – was reportedly granted more than $3 million, including over $300,000 in 2015 alone. That’s a hell of a lot of rodent royal rumbles. Some of these highly educational (and even more highly hilarious) experiments have involved a sort of home turf ‘roid rage test: hamsters were injected with steroids, then had another hamster placed in his cage to see if the drugged rodents were more aggressive when protecting their territory. In other contests, a teetotaling hamster was pitted against a combatant shot up with cocaine. Other tests investigated whether becoming a “trained fighter” through two weeks of face-offs made the critters more aggressive. The study led to one of the greatest thesis headlines in academic history: “Prior fighting experience increases aggression in Syrian hamsters: implications for a role of dopamine in the winner effect.” The experiments ceased after animal activists with no sense of humor pressured the university to eliminate the program. Unfortunately for the coked up hamsters, no funding was available for rodent rehab.

7 Crippling College Debt? Thy Name is Mudd

As in Harvey Mudd College of Claremont, California. Watch this video on YouTube The two most expensive universities in the United States are (1) the University of Chicago and (2) Columbia. Both are top-ten academically accredited “write your own ticket” institutions, meaning a degree from either gives graduates such tremendous advantages that shelling out north of $300,000 for a four-year diploma turns into a sound investment. The third most expensive college is another household name instantly recognizable for its academic excellen… oh wait, sorry. It’s Harvey Mudd College, a $79,539-per-year institution of higher learning that few people have ever heard of. Granted, Harvey Mudd College has a specialty: its curriculum focuses largely on science and engineering. Still, plenty of colleges with more recognizable names offer such programs, without the risk of a would-be employer glancing at a graduate’s resume and thinking: “he went WHERE now?” An honorable mention goes to Scripp’s College, an all-women’s school whose $77,588 annual tuition makes it the sixth most expensive in America despite a similar lack of notoriety.

6 A Legendary Box Office Disaster

In 2017, Warner Brothers Studios released “Arthur: Legend of the Sword,” an epic fantasy action/adventure film directed and co-written by Guy Ritchie. A tribute to the famous king and his Knights of the Round Table, Legend of the Sword was intended as the first of a six-movie series. The goal was Fast & Furious on horseback – a Medieval answer to lucrative, long-running cinema franchises. To launch the endeavor, Warner Bros. gave Ritchie and his filmmaking team a long leash: a whopping $175 million production budget. Critics weren’t sold. Legends of the Sword sports a dismal 30% approval rating on review aggregator Rotten Tomatoes, whose critical consensus reads, “King Arthur: Legend of the Sword piles mounds of modern action flash on an age-old tale – and wipes out much of what made it a classic story in the first place.” The moviegoing public concurred. On its debut weekend in the US, Legends of the Sword finished third among all films, taking in just $15 million across 3,200 screens. That’s a lot of empty thrones in the theaters. The studio ultimately recouped just $25 million from its investment, making Legends of the Sword the most money-losing film of all time. Rounding out the top three historic movie money-losers are (#2) 2003’s “Sinbad: Legend of the Seven Seas,” which lost $125 million; and (#3) 2012’s “John Carter,” which lost $122 million.

5 Dumpster Diving for Dividends

In 2013, James Howells, an IT worker living in the UK, was cleaning out his house. He had two identical hard drives, and figured he could stand to part with one. He drove to the landfill in Newport, South Wales and discarded it. Howells was an early adopter of the cryptocurrency Bitcoin. Amassing 7,500 bitcoins when it was new and inexpensive, he’d stashed his crypto-cash onto a hard drive as an investment. Fortunately for Howells, by 2013 each bitcoin was worth $17,000, meaning he was cyber-sitting on a nest egg of over $125 million. Unfortunately for Howells, the cryptographic “private key” needed to access his bitcoin windfall was in… you guessed it… the hard drive he’d just dropped at a landfill. Eight years later, Howells’ trashed trove is worth an eye-popping $280 million. To this day, local authorities have refused his pleas to search the landfill in search of his buried treasure, citing environmental and funding concerns. Attempting to alleviate the latter issue, Howells has offered to donate 25% of the haul — some $71 million — to a “Covid Relief Fund” for the city if he manages to dig up the hard drive. As of late January, the Newport City Council has rejected Howells’ nine-figure scavenger hunt, with no signs of budging. “The cost of digging up the landfill, storing and treating the waste could run into millions of pounds, without any guarantee of either finding it or it still being in working order,” a town council spokesman said. Howells, it seems, is shit-coin out of luck.

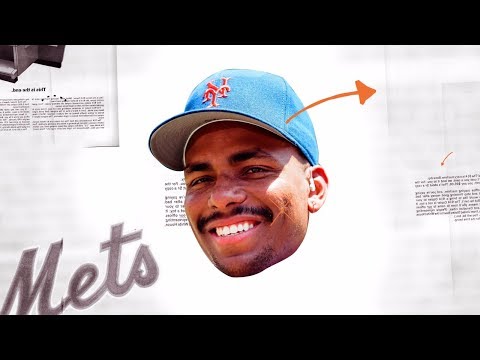

4 So Dumb They Made It A Day

The most celebrated day in American sports is April 15. That’s the date in 1947 that Jackie Robinson took the field as a Brooklyn Dodger, breaking baseball’s color barrier and truly making the game America’s national pastime. The most mocked day in American sports is probably July 1. That’s the day that, each year, the New York Mets pay a player more than a million dollars… despite the fact that he hasn’t played a game this CENTURY. The story goes like this: By 1999, the Mets had pretty most had it with Bobby Bonilla, a big-money bust who never lived up to his hype. The team decided to part ways with the aging third baseman, despite still owing him $5.9 million for the upcoming 2000 season. But instead of simply buying out his contract and being done with him, the Mets opted for an arcane agreement in which payments would be deferred until 2011, as if $6 million would make or break a franchise worth half a billion bucks per 2002 figures. The deferment included an 8% annual interest accruement. As a result, Bonilla has received about $1 million each July 1 – known throughout baseball as Bobby Bonilla Day – since 2011, and will continue to receive annual instalments until 2035. Upon the deal’s completion, Bonilla will be 72 years old and the Mets will have paid out nearly $30 million to defer $5.9 million.

3 Bloomberg or Bust

It was late 2019 and, in the US, things weren’t going well for the Democratic Party establishment. The assumed frontrunner, former Vice President Joe Biden, was underperforming in both debates and polls, opening the door for Socialist Bernie Sanders to have a path to the presidential nomination. So onto the political scene strode a towering 5’6” billionaire: media magnate Michael Bloomberg. So centrist that he was a Republican during his three terms as mayor of New York City, Bloomberg devised an unconventional primary strategy: not to compete in the four states with February primaries, but rather focus on Super Tuesday – a date in early March when more than a dozen states vote. What followed was the most saturating media blitz in the history of politics, American or otherwise. Bloomberg spent $188 million in the 4th quarter of 2019, including $132 million on television ads and $8.2 million on digital platforms. By February, the price tag had exceeded HALF A BILLION dollars – easily the most expensive primary campaign ever. Unfortunately for Mayor Mike, no one was buying it. Bloomberg finished no higher than third place in any of the 14 Super Tuesday contests, and suspended his campaign shortly thereafter. In the apportioned system of Democratic primary voting, that gave Bloomberg a pathetic 58 of the 1,991 delegates needed to secure the nomination. That translates to $17,241,379 per delegate.

2 Fast Track to the Poorhouse

In 2008, California announced an ambitious project: a decade-long infrastructure initiative to link its two most prominent cities, Los Angeles and San Francisco, by high-speed rail. The effort was intended to provide an eco-friendly alternative to flying between the southern and northern hubs of the expansive state, and to help close the bullet train gap between the US and other developed nations. The 2008 price tag was eye-popping: $33 billion, with service commencing in 2020. Cost-benefit questions abounded, including the wisdom of a high-speed rail station in Los Angeles, the most spread out and therefore car-centric city in the country. Of course, 2020 has now come and (thankfully) gone, with no high-speed rail service in sight. California being California – a red-tape draped state where committees, permits and legal entanglements cause notorious delays – the project’s estimated cost now exceeds $100 billion, with an uncertain completion date. That works out to about $192 million per mile for the 520-mile rail service. This for a project with no easily-converted customers – Californians have little history with rail ridership, precisely because of the state’s enormity – in a state that is currently $575 billion in debt.

1 A Trillion-dollar Paperweight

It’s a bird! It’s a plane! It’s a… wait, yeah it’s a plane. Only it doesn’t go anywhere and cost more than a TRILLION dollars to develop. In late February, the US Air Force admitted what had long been suspected: a warplane more than two decades in the making was a dud. In the 1990s, the Air Force began designing a next-generation fighter jet designed to be lighter and more sophisticated than its predecessors. The goal was to replace the existing fleet of Cold War-era F-16 fighter planes. Then the USA’s notorious military industrial complex happened. Over (far too much) time, the lightweight replacement fighter got heavier and more expensive as the Air Force and lead contractor Lockheed Martin packed it with an endless array of bells and whistles. Twenty years later the slow, clunky 25-ton “stealth” aircraft has become the very problem it was intended to solve. “They tried to make the F-35 do too much,” under-stated Dan Grazier, an analyst with the Project on Government Oversight in Washington, D.C. The final price tag for this bloated bust approached an astounding $1.7 TRILLION. That’s enough to give each of the more than 330 million living Americans $5,000 in cash. Up next is more of the same: In a profligate nod to 90s nostalgia, Air Force Chief of Staff Gen. Charles Brown Jr. just announced plans to design a lightweight fighter jet to replace the existing fleet of Cold War-era F-16s. See ya in 2040, General. Top 10 Bizarre Ways To Make Money From Disgusting Habits Read More: Twitter Website